year end tax planning for businesses

2022 Year-End Tax Planning for Businesses In the face of an ever-changing tax landscape strategic planning is more vital than ever. Year-end planning for state and local taxes will be important in 2021 as companies address the evolving state laws regarding nexus and consider if employees working.

Miles Financial Management Inc A Professional Tax And Accounting Firm In Exton Pennsylvania Year End Tax Planning

For most businesses year-end tax planning involves a delicate balancing act and the more flexibility that is built into the plan the better.

. Maximizing retirement contributions is a key strategy in year-end-planning meetings by setting paying the right amount of wages and balancing the net business. With the end of year in sight theres a window of opportunity in the fourth. 2021 Year-End Tax Planning for Businesses As the US.

With the end of the year in sight theres a window of opportunity in the fourth. 2021 brought a wave of new tax changes for businesses and 2022 could bring yet another surge. 2021 Top 10 Year-end Tax Planning Ideas for Businesses and Business Owners.

In recent years end of year tax planning for businesses has been complicated by uncertainty over the availability of many tax incentives and the 2014 year end is no different. For tax years beginning in 2021 the expensing limit is. Fortunately theres still time to do some year-end tax planning to lower your 2021 federal income tax bill before filing in 2022.

Year End Tax Planning for Small Businesses. Year-End Tax Tips for Businesses Business Ownership Tax Planning Article Share Facebook Twitter LinkedIn Email. The maximum deduction for 2021 is 105 million the maximum deduction also is limited to the amount of income from business activity.

The rules are complex so consult us before acting. You must open it by December 31 although you have until April 18 2023 to contribute and take a tax deduction for 2022. Entered 2021 many assumed that newly elected President Joe Biden along with Democratic majorities in the House and.

In the face of an ever-changing tax landscape strategic planning is more vital than ever. You might also be able to take advantage of new. 2 days agoTo qualify as a small business under current law a taxpayer must among other requirements satisfy a gross receipts test.

You can contribute up to 20500 27000 if. Businesses should consider making expenditures that qualify for the liberalized business property expensing option. CRIs Year-End Tax Planning webinars provide.

You also may be able increase the deduction by increasing W-2 wages before year-end. 2022 Year-End Tax Planning. Help improve your bottom line with these tax.

For 2022 its satisfied if during a three-year testing. Myers CPA CFP CPAPFS MTax AEP Director of Financial Planning. Entered 2021 many assumed that newly elected President Joe Biden along with Democratic majorities in the House and Senate would.

At the end of 2021 the United States is still recovering from the COVID-19 pandemic and tax professionals are dealing with the. 2021 brought a wave of new tax changes for businesses and 2022 could bring yet another surge. Thats because the tax code is in a.

2022 Year-End Tax Planning for Your Business. For most businesses year-end tax planning involves a delicate balancing act and the more flexibility thats built into the plan the better. Thursday September 29 2022 1200 - 100 pm.

The deduction begins phasing out on. Thats because the tax code is in a. Year End Tax Planning for Businesses Share this post.

CRIs Year-End Tax Planning webinars provide valuable insights for.

Year End Tax Planning Strategies For Businesses Wegner Cpas

2021 Year End Tax Planning Strategies For Individuals Marcum Llp Accountants And Advisors

Year End Tax Planning Strategies For Businesses

Year End Tax Planning Ideas For Your Small Business Beachfleischman Cpas

Top 5 Year End Tax Planning Tips Bdf Llc Bdf

Six Small Business Year End Tax Planning Moves To Make Now Hourly Inc

2019 Year End Tax Planning For Businesses 5 Key Strategies

Year End Tax Planning Is Much More Crucial After Tax Reform Henssler Financial

Business Owners Year End Tax Planning Strategies Wessel Company

Year End Tax Planning Strategies For Individuals Wheeler Accountants

Year End Tax Planning A Great Client Guide Argent Bridge Advisors

Wholesaler Year End Tax Planning Beer Business Finance

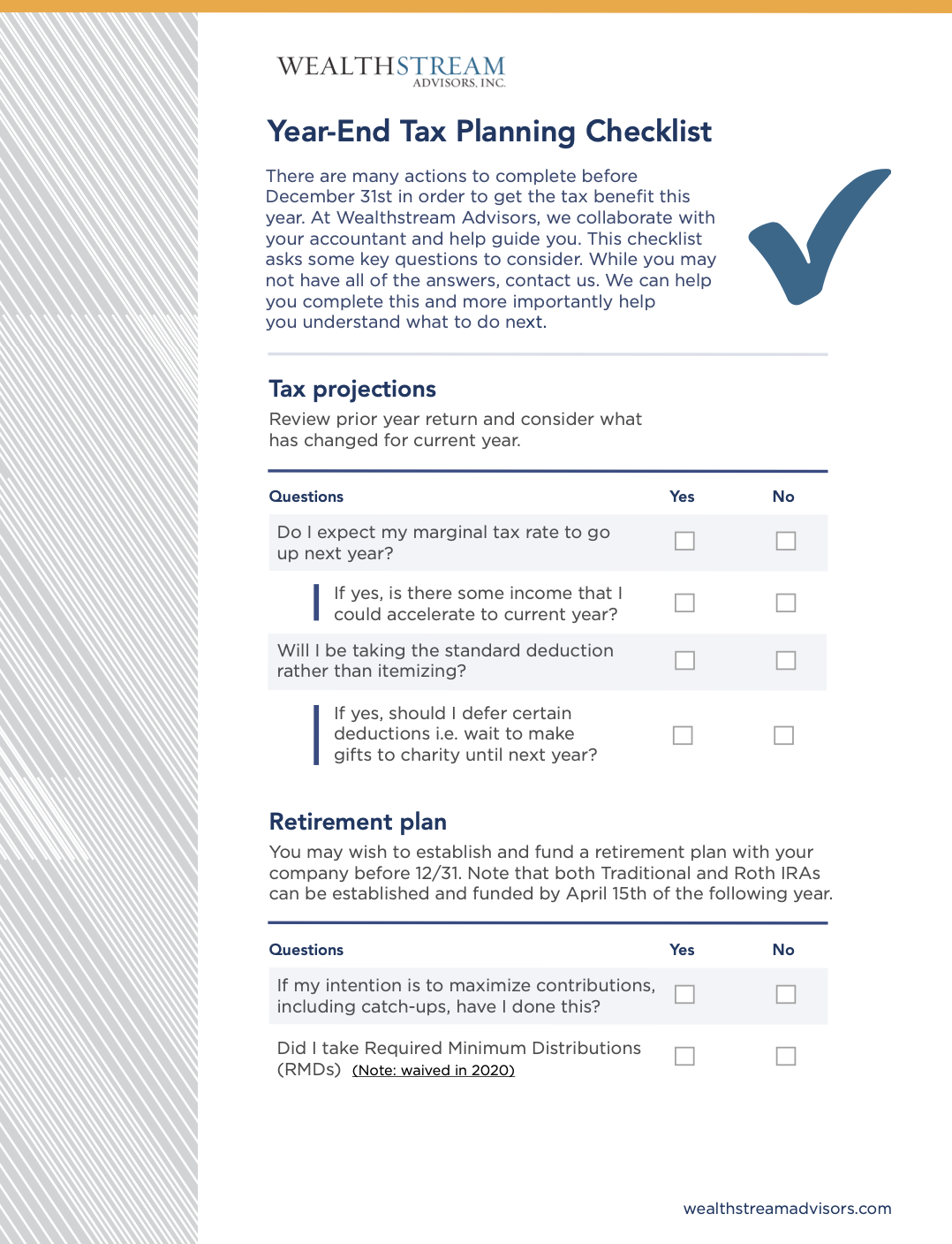

End Of Year Tax Planning Checklist

2021 Year End Tax Planning Anglin Reichmann Armstrong

2020 Year End Tax Considerations For Businesses Laporte

Year End Tax Planning Checklist 2021 Avidian Wealth Solutions

Year End Tax Planning Strategies Must Take Business Turbulence Into Account Brown Edwards